IN THE KNOW

Naval sinking, construction tragedy, falling palm trees and more

Insurance makes the world go round. Every news story has an insurance component. Here’s how insurance in Malaysia affects some of the most dramatic news stories we’ve seen in our region recently.

Navy Ship HMNZS Manawanui Sinks – Marine Insurance

When the New Zealand Navy ship HMNZS Manawanui sank off the Samoan coast after running aground on a reef, 75 passengers and crew had to be evacuated via life rafts. So what caused the sinking and who pays for the ship’s replacement?

The Manawanui, a specialist dive and hydrographic vessel, is designed to support salvage and survey projects, and she’d been carrying out a reef survey when she ran aground off Upolu. Because the weather conditions were so terrible it took the first people who left the ship five hours to get to safety. One small rescue vessel flipped on the reef, leaving people to walk to dry land. Three people were sent to hospital.

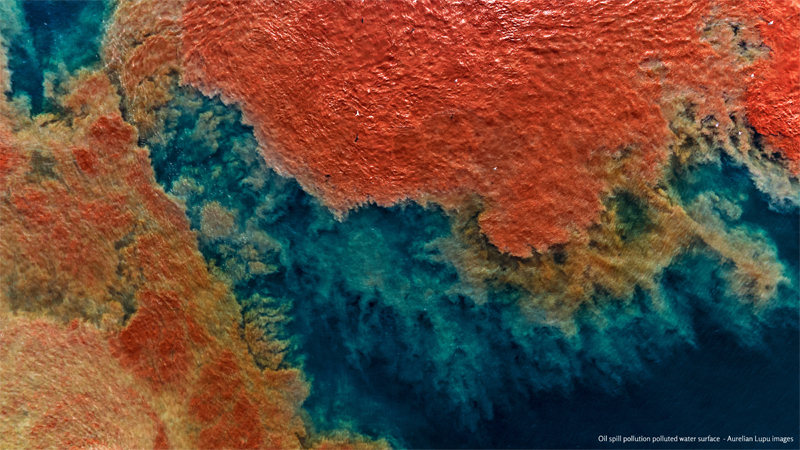

The ship eventually caught fire, capsized and sank, fully underwater by 9am. Now there are concerns about reef damage and oil pollution. But there are also worries about the way the incident is being talked about by male captains and seafarers. The captain was female and, as Judith Collins, New Zealand’s Defence Minister, said, “What is not tracking well is the deeply concerning misogynistic narrative that reared its head before our people had even made it home to New Zealand. A court of inquiry has been stood up to establish what caused this terrible incident. The one thing that we already know did not cause it is the gender of the ship's captain.”

So what about the marine insurance side of naval vessels? Military Ship Insurance is a matter for specialist experts, with specialised policy benefits tailored to meet the unique risks and legal considerations involved in the military.

Construction Workers Killed – Construction, Engineering, and Accident Insurance

A foreign construction worker died in mid-October and two others survived when a part-completed building collapsed near Jalan Bukit Senjuang. The man who tragically died was trapped in fallen rubble that was once a concrete pillar.

The two survivors, both Pakistani nationals, suffered injuries to the neck, shoulder and head, pulled out of the rubble and sent to hospital in Melaka for treatment. So what went so badly wrong that an almost-completed building fell down without warning?

The Melaka Historic City Council confirmed the building was built without permission, by a privately owned company that didn’t submit plans to the local authorities. Hopefully the building firm was covered by construction and engineering insurance, but the fact that the developers didn’t have the right permissions means their policy – if there was one – would invalidate the cover and no claims would be paid. If they held accident insurance to protect their workers, the policy would also be void. Now the building’s owner faces a maximum fine of RM50,000.

Palm Tree Falls On a Motorcycle – Vehicle Insurance and Public Liability Cover

Two people were badly injured on the way home from school in bad weather, when a palm tree fell on a woman’s motorcycle at Kilometre 23, Jalan Lipis-Benta in Kuala Lipis. The area’s police chief confirmed the motorcycle rider, 37-year-old S. Dhanalekchumi from Taman Teratai, Benta, was left with neck injuries and her son, just seven years old, suffered bad head and chest injuries. Both of them were treated at Kuala Lipis Hospital, and the police appealed for more information from the public.

Cities have comprehensive public liability policies to compensate ordinary people who suffer from this kind of accident. The people involved might have held a personal accident policy that many have paid out depending on the cover they bought. They’ll definitely have a vehicle insurance policy which should cover the damage to their bike.

It’s important to get the right insurance protection because unexpected tree falls in our region seem to be happening more often.

Golf Injury Prevents Nelly Korda from Playing in Malaysia – Golfer Insurance

Champion female US golfer Nelly Korda had to withdraw from two prestigious LPGA tournaments because of a minor neck injury she suffered when practising. She won’t be playing at the events, one in Korea and the other the Maybank Championship in Malaysia, and this is the second time this year that an injury that has prevented her from competing. In June she was bitten by a dog and had to withdraw from a competition because of her injuries.

We imagine Nelly has a good quality golfer insurance policy similar to the one we sell, which covers golfers for all sorts of risks depending on their needs: loss, damage or theft of your own and hired golf equipment, dental treatment, accidental damage to other people’s property, hospitalisation, golf club subscription reimbursement, public liability, personal accident cover, hole in one cover and more.

The Record-Breaking Isuzu D-Max Does It Again – Vehicle Insurance and Event Insurance

The awesome Isuzu D-Max is taking fuel efficiency to exciting new places, breaking its own record. Recently the car drove an impressive two thousand kilometres on just 76 litres of diesel fuel, travelling all the way from Thailand to Malaysia, kicking off in Thai town of Phitsanulok and ending the adventure in Klang, Selangor. The original record was broken when the vehicle drove 1809 km from Bangkok to Singapore on a single tank of fuel.

The event was the Isuzu Malaysia Dura Miles Challenge, in which three different models of the D-Max competed: the 1.9-litre 4×2 Auto Plus, a 1.9-litre 4×4 Auto Premium, and a 3.0-litre 4×4 X-Terrain. The record will be entered into the Malaysia Book of Records for the Longest Distance Driven In A Pick-up Truck With A Single Tank Of Fuel.

So what kind of vehicle insurance do you need for an event like this? Again it’ll be a specialist insurance policy, since driving competitions aren’t covered by a regular commercial or personal vehicle policy. The organisers may have also bought an event insurance policy to cover the event itself.

The Insurance You Need – Get It Right First Time

As you can see, insurance can be complicated. While ordinary, everyday risks are usually covered by a normal policy, anything out of the ordinary deserves special attention. Whatever kind of cover you need, get in touch and we’ll offer expert advice and guidance about getting the right insurance in Malaysia.

https://www.msn.com/en-nz/news/national/hmnzs-manawanui-what-we-know-about-the-navy-ships-sinking/ar-AA1rLPgO

https://www.malaymail.com/news/malaysia/2024/10/12/bangladeshi-construction-worker-dies-two-pakistanis-injured-after-melaka-building-collapses/153320

https://www.malaymail.com/news/malaysia/2024/10/16/mother-and-son-seriously-injured-by-falling-palm-tree-in-kuala-lipis/153851

https://www.nbcsports.com/golf/news/nelly-korda-explains-withdrawals-from-lpga-events-in-south-korea-and-malaysia

https://autobuzz.my/2024/10/11/isuzu-d-max-drives-2000-km-from-thailand-to-malaysia-on-one-tank-of-fuel-enters-malaysia-book-of-records/